SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. )

(Name of Registrant as Specified In Its Charter) | ||

(Name | ||||

NoticePerson(s) Filing Proxy Statement, if other than the Registrant)

Filing Fee (Check the appropriate box):

![[MISSING IMAGE: lg_principalreg-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/lg_principalreg-pn.jpg)

Chairman, President, and Chief Executive Officer

Principal Financial Group®

Dear Fellow Shareholders:

You are invitedour 62 million customers1. I’m proud of our persistent focus and execution, intent on maximizing your investment as a Principal shareholder.

As you can see, we have some exciting newschanging client demands. Our offerings continue to share.resonate with investors. For example:

|  |

We're

The noticeworld. They enabled us to effectively work through challenges and seize emerging opportunities.

We had a significant changemore than $18 million in leadership of the Company in 2015, with Larry Zimpleman transitioning to Chairman, and Daniel Houston taking on the role of Chief Executive Officer as a part of our planned leadership succession. More change will come following the annual meeting when Mr. Houston takes over as Chairman and Mr. Zimpleman leaves the Board having completed his last term.

We also went through an exciting initiative to redefine the Principal® brand. We continue to improve on providing a quality customer experience, simplifying our value proposition, and being a great place to do business and a successful global organization.

We2023. I encourage you to read more about this proxy statement and vote your shares. Youother ways we’re making a difference in our Sustainability Report at principal.com/sustainability.

| | Sincerely, ![[MISSING IMAGE: sg_danhouston-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/sg_danhouston-pn.jpg) Daniel J. Houston Chairman, President, and CEO Principal Financial Group | | | ![[MISSING IMAGE: ph_danhouston-lrgbw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_danhouston-lrgbw.jpg) | |

![[MISSING IMAGE: lg_principalreg-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/lg_principalreg-pn.jpg)

Lead Director

Principal Financial Group®

Distribution of annual meeting materials

As we've donedelivered in the past,face of challenging macroeconomic and market conditions. These results are a testament to the company’s strategy, focus, and discipline and the diligent work done day in and day out by employees around the globe.

Sincerely,

Larry D. ZimplemanChairman

Sincerely,

Daniel J. HoustonPresident and Chief Executive Officer

April 7, 2016

opportunity to do this work on your behalf.

| | ![[MISSING IMAGE: sg_scottmills-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/sg_scottmills-bw.jpg) Scott Mills Lead Director Principal Financial Group | | | ![[MISSING IMAGE: ph_scottmills-lrgbw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_scottmills-lrgbw.jpg) | |

| | ||||||||||

Proposals: | | |||||||||

| | | |||||||||

| 1. | | | Election of four Directors for three-year terms | | | | ![[MISSING IMAGE: ic_tickmark-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmark-pn.jpg) FOR each FOR eachSee page 10 | | ||

| | 2. | | | | Advisory approval of the compensation of our named executive officers | | | | ![[MISSING IMAGE: ic_tickmark-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmark-pn.jpg) FOR FORSee page 66 | |

| | 3. | | | | Ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for 2024 | | | | ![[MISSING IMAGE: ic_tickmark-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmark-pn.jpg) FOR FORSee page 67 | |

The annual meeting of shareholders of Principal Financial Group, Inc. ("Company" or "Principal")

1.To elect four Class III Directors;2.To hold an advisory voteable toapprove the compensation of our named executive officers;3.To ratify the appointment of Ernst & Young LLP as the Company's independent auditors for 2016; and4.Totransact such other business as may properly come before the meeting.

The Company has not received notice of other matters that may be properly presented at the annual meeting.

![[MISSING IMAGE: sg_natalielamarque-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/sg_natalielamarque-bw.jpg)

Executive Vice President, General Counsel and Secretary

| | Meeting Information | | ||||||

![[MISSING IMAGE: ic_meeting-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_meeting-pn.gif) | | | Meeting date: Tuesday, May 21, 2024 | | ||||

![[MISSING IMAGE: ic_meetingtime-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_meetingtime-pn.gif) | | | Time: 9:00 a.m., Central Daylight Time | | ||||

| | ![[MISSING IMAGE: ic_location-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_location-pn.gif) | | | | Location: This will be a virtual only meeting which you can join at: www.meetnow.global/MVC9L9P. | | ||

| | Voting | | ||||||

| | Your vote is important! Please take a moment to vote by internet, telephone, or proxy or voting instruction card as explained in the How Do I Vote sections of this proxy statement. | | ||||||

| | ![[MISSING IMAGE: ic_globe-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_globe-pn.gif) | | | | Through the visit the website noted in the notice of | | ||

| | ![[MISSING IMAGE: ic_telephone-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_telephone-pn.gif) | | | | By telephone: call the | | ||

| | ![[MISSING IMAGE: ic_mail-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_mail-pn.gif) | | | | Mail Complete, sign, and promptly return a proxy or voting instruction cardin the postage paid envelope provided. | | ||

If you attend the meeting, you will need to register and present a valid, government issued photo identification. If your shares are not registered in your name (for example, you hold the shares through an account with your stockbroker), you will need to bring proof of your ownership of those shares to the meeting in order to register. You should ask the broker, bank or other institution that holds your shares to provide you with either a copy of an account statement or a letter that shows your ownership of Principal Financial Group, Inc. common stock on March 22, 2016. Please bring that documentation to the meeting to register.

By Order of the Board of Directors

Karen E. ShaffExecutive Vice President, General Counsel and Secretary

April 7, 2016

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 17, 2016:

May 21, 2024:

Your vote is important! Please take a moment to vote by Internet, telephone or proxy card as explained in the How Do I Vote sections of this document.

| | |||||||

| | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 1 | |

| | Notice of Annual Meeting of Shareholders | | | | | 1 | | |

| | | | | | | | ||

| | Table of Contents | | | | | 2 | | |

| | | | | | | | ||

| | Proxy Summary | | | | | 3 | | |

| | | | | | | | ||

| | Corporate Snapshot | | | | | 3 | | |

| | | | | | | | ||

| | Year Over Year Performance Highlights | | | | | 4 | | |

| | | | | | | | ||

| | Industry Recognition | | | | | 5 | | |

| | | | | | | | ||

| | Director Qualifications, Director Tenure, Process for Identifying and Evaluating Director Candidates, and Diversity of the Board | | | | | |||

| | | |||||||

| | | | | | | | ||

| | Proposal | | | | | |||

| | | |||||||

| | | | | | | | ||

| | Corporate Governance | | | | | | | |

| | | | | | | | ||

| | | | | | 20 | | | |

| | | | | | | | ||

| | | | | | 21 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | ||||

| | | |||||||

| | Sustainability at Principal

| | | | | | | |

| | | | | | | | ||

| | Compensation of Non-Employee Directors | | | | | 28 | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Other Compensation

| | | | | 30 | | |

| | | | | | | | ||

| | | | | | ||||

| | | |||||||

| | | | | | | | ||

| | Executive Compensation | | | | | | | |

| | | | | | | | ||

| | Executive Summary

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 34 | | | |

| | | | | | 35 | | | |

| | | | | | 36 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Base Salary

| | | | | | |

| | | | | | | | ||

| | | | | | 44 | | | |

| | | | | | | | ||

| | Benefits

| | | | | | | |

| | | | | | | | ||

| | Stock Ownership Guidelines

| | | | | | | |

| | Hedging and Pledging Policy

| | | | | | | |

| | Repricing Policy

| | | | | | | |

| | Clawback Policy

| | | | | | | |

| | Gross-Up Policy

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | |

| | |

| | ||||||||

| | | | | | | |||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | ||||

| | | |||||||

| | | ||||||

| | |||||||

| | |||||||

| | | | | | | | ||

| | | | | | ||||

| | | |||||||

| | | | | | 62 | | | |

| | | | | | 63 | | | |

| | | | | | 64 | | | |

| | | | | | 64 | | | |

| | | | | | | | ||

| | Proposal | | | | | |||

| | | |||||||

| | | | | | | | ||

| | Proposal | | | | | | | |

| | | | | | | | ||

| | Audit-Related Fees

| | | | | | | |

| | | | | | | | ||

| | | | | | ||||

| | | |||||||

| | | | | | | | ||

| | Security Ownership of Certain Beneficial Owners | | | | | | | |

| | | | | | ||||

| | | |||||||

| | | | | | | | ||

| | Questions and Answers About the Annual Meeting | | | | | |||

| | | |||||||

| | | | | | | | ||

| | Appendix A Executive Compensation Benchmarking Study Participants | | | | | A-1 | | |

| | | | | | | | ||

| | Appendix B | | | | | B-1 | | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 2 | |

| | | | | | | | | |||

| | | | | | | | | |||

| | | | | | | | |

![[MISSING IMAGE: fc_corpsnapshot-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/fc_corpsnapshot-pn.jpg)

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 3 | |

| | Dividend per share ![[MISSING IMAGE: bc_performance-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/bc_performance-pn.jpg) | | | | 2023 Pre-tax operating earnings1 ![[MISSING IMAGE: pg_financial-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/pg_financial-pn.jpg) | |

| | Company Highlights | | | | Business Unit Highlights | | | | ||

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Returned $1.3 billion of capital to shareholders in 2023, including $0.7 billion of share repurchases and $0.6 billion in common stock dividends ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Strong capital position with $1.7 billion of excess and available capital at year-end | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Retirement and Income Solutions full-year sales increased 9% over 2022, including $2.9 billion of pension risk transfer sales ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Principal Global Investors managed AUM of $499.5 billion, increased 7% over 2022 ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Principal International reported record AUM of $180.4 billion, increased 15% over 2022 ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Specialty Benefits premium and fees increased 9% over 2022, driven by record full-year sales, strong retention, and employment and wage growth | | | | | |

| | | | | | | | | | ||

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 4 | |

| | Overall | | | | Retirement and Income Solutions | |

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) 236 on Fortune magazine’s list of the Largest 500 Corporations based on revenues (Feb 2024) | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Top 3 401(k) recordkeeper based on number of participants. 2023 PLANSPONSOR Defined Contribution Plan Recordkeeping Survey. (July 2023) | |

| | | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) No. 1 defined benefit plan service provider. PLANSPONSOR Defined Benefit Administration Survey. (August 2023) | |

| | | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) No. 1 ESOP service provider. 2023 PLANSPONSOR Defined Contribution Plan Recordkeeping Survey. (July 2023) | |

| | | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) CIO Industry Innovation—Winner Real Assets and Infrastructure Award (December 2023) | |

| | Asset Management | | | | Benefits and Protection | |

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Ranked 27th largest manager of worldwide institutional assets under management of 434 managers profiled. Assets as of December 31, 2022. (“Largest Money Manager” Pensions & Investments. June 2023) | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) No.1 Non-Qualified Deferred Compensation provider. 2023 PLANSPONSOR Defined Contribution Plan Recordkeeping Survey. (July 2023) | |

| | Workplace Excellence | | | | Sustainability Management | |

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Named a Best Place to Work in Money Management by Pensions & Investments for the 12th consecutive year. (December 2023) ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Scored 100 out of 100 on the Diversity: IN Disability Equality Index (DEI) for our disability inclusion efforts. (July 2023) | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) CDP Climate Change Management status of “B”. (February 2024) ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Included in the JUST 100 as one of 2024 America’s Most JUST Companies by JUST Capital (February 2024) | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 5 | |

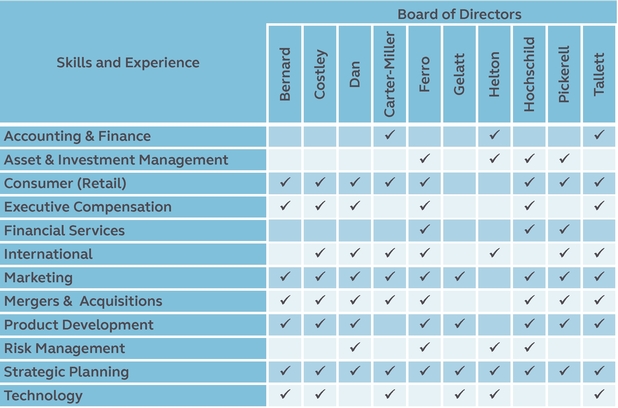

| | Board Skills and Attributes Assessment | | | | The Nominating and Governance Committee is responsible for recommending Director candidates to the Board for election at each Annual Meeting. The Nominating and Governance Committee of the Board of Directors (the “Board”) regularly assesses the expertise, skills, backgrounds, competencies, and other characteristics of Directors and candidates for Board vacancies considering the current Board composition and the Company’s existing strategic initiatives, risk factors, and all other relevant circumstances. The Committee also assesses current Directors’ and candidates’ personal and professional ethics, integrity, values, independence, and ability to contribute to the Board, including current employment responsibilities. In addition to personal attributes, our Board values experience as a current or former senior executive in financial services, in international business, and with financial management or accounting responsibilities. Other competencies valued by the Board include strategic and results orientation, comprehensive decision-making, risk-management skills, and an understanding of current technology issues. These assessments provide direction for searches for Board candidates and in the evaluation of our current Directors. | |

| | Director Nomination Process | | | | The Committee reviews the performance of each Director whose term is expiring as part of the determination of whether to recommend the Director for reelection to the Board. As part of this process, the Committee receives input from the other Directors, and to the extent engaged, an independent consultant. The Nominating and Governance Committee evaluates Director performance and capabilities against desired characteristics and relevant considerations, including those noted above. | |

| | Feedback and Action | | | | Following the Nominating and Governance Committee’s discussion, the independent consultant, if one is used, or the Committee Chair provides feedback to the Directors who were evaluated. The Board annually conducts a self-evaluation regarding its effectiveness, and the Audit, Finance, Human Resources, and Nominating and Governance Committees also annually evaluate their respective performance. | |

| | All Board members have: | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.gif) Personal character that supports the Company’s core value of integrity; | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.gif) Training or experience that is useful to us in light of our strategy, initiatives, and risk factors; and | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.gif) A demonstrated willingness and ability to prepare for, attend, and participate effectively in Board and Committee meetings. | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 6 | |

All Board members have:

•Experience which support the Company's core value of integrity;•Training or experience which is useful to Principal in light of its strategy, initiatives and risk factors; and•A demonstrated willingness and ability to prepare for, attend and participate effectively in Board and Committee meetings.

Several current independent Directors have led businesses or major business divisions as CEO or President (Ms. Bernard, Dr. Costley, Mr. Dan, Mr. Ferro, Dr. Gelatt, Mr. Hochschild, Mr. Pickerell and Ms. Tallett).

Though the Board does not haveresponsibilities.

| | | | | Auerbach | | | Beams | | | Carter-Miller | | | Hochschild | | | Mills | | | Muruzabal | | | Mitchell | | | Nordin | | | Rivera | | | Pickerell | | | Richer | |

| | Senior Executive Experience | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Accounting & Finance | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Asset & Investment Management | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Consumer (Retail) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | |

| | Executive Compensation | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Financial Services | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Human Resources/Talent Management | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | International | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | |

| | Marketing | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | |

| | Mergers & Acquisitions | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Product Development | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Risk Management | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Strategic Planning | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Sustainability/ESG | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | |

| | Technology | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 7 | |

![[MISSING IMAGE: pc_gender-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/pc_gender-pn.jpg)

![[MISSING IMAGE: pc_racial-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/pc_racial-pn.jpg)

| | Board Diversity Matrix (As of 4/8/2024) | | ||||

| | Total Number of Directors | | | | 12 | |

well. Principal has been recognized as one of the National Association of Female Executives' Top Companies for Executive Women for 13 consecutive years; received top marks from the Human Rights Campaign Foundation's 2016 Corporate Equality Index; Female Male Non-Binary Did Not

Disclose Gender Gender Identity Directors 0 0 Demographic Background African American or Black 0 0 Alaskan Native or Native American 0 0 0 0 Asian 0 0 0 0 Hispanic or Latinx 0 0 0 Native Hawaiian or Pacific Islander 0 0 0 0 White 0 0 Two or More Races or Ethnicities 0 0 0 0 LGBTQ+ 0 0 0 0 Did Not Disclose Demographic Background 0 0 0 0

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 8 | |

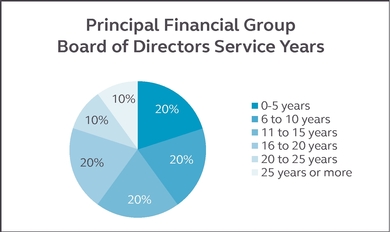

gender diversity of our Board. The Board believes that its thorough Director performance reviews and healthy Board refreshment processes better serve Principal and its stakeholders than would mandatory term limits. Strict term limits would require that Principal losefollowing reflects the continuing contribution of Directors who have invaluable insight into Principal and its industry, strategies and operations as a result of their experience. Directors' terms must not extend past the annual meeting following their 72nd birthday. The tenure of theour independent directors:

![[MISSING IMAGE: bc_boardrefresh-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/bc_boardrefresh-pn.jpg)

Two new independent Directors were added to the Board in 2015: Roger C. Hochschild and Blair C. Pickerell. Mr. Hochschild has executive level experience in asset and investment management, retail consumer services, executive compensation, financial services, marketing, mergers & acquisitions, product development, risk management and strategic planning. Mr. Pickerell has extensive experience with the asset and investment management and financial services industries as well as considerable international expertise. Both additions were the result of a lengthy search that included consideration of numerous highly qualified director candidates. The search was led by the Nominating and Governance Committee, with the assistance of a search firm. Director candidates met with Betsy J. Bernard, Chair of the Nominating and Governance Committee, Lead Director Elizabeth Tallett, Mr. Zimpleman (then Chairman and CEO) and other members of senior management. The Nominating and Governance Committee is in the process of identifying a replacement for Dr. Costley, who has reached the Board's retirement age. We anticipate that three additional tenured Directors will be replaced over the next six years, continuing our process of regularly refreshing the talents and perspectives reflected on our Board. The tenure of the Directors, as reflected in the chart above, balances deep knowledge of the Company, its industry and relevant issues, with fresh perspectives and additional expertise, while providing the oversight and independence needed to meet the interests of our shareholders.

Communicating with stakeholders including clients, customers, employees, and investors, has always been an important part of how Principal conducts its business. Principal has had in place for some time a formal engagement process with shareholders around matters of corporate governance. This past year, with the Board's Lead Director, we met in person with holders of a significant percentage of the Company's outstanding Common Stock and had robust discussions regarding our core corporate governance policies. These discussions provided us with helpful insight into shareholders' views on current governance topics, which were reported to the Nominating and Governance Committee and the full Board. This process, and past engagement efforts, regularly supplement relevant communications regarding corporate governance made through the Company's website and by the Investor Relations staff.

The Nominating and Governance Committee will consider shareholder recommendations for Director candidates sent to it c/o the Company Secretary. Director candidates nominated by shareholders are evaluated in the same manner as Director candidates identified by the Committee and search firms it retains.

| | 2019 | | | | 2020 | | | | 2021 | | | | 2022 | | ||||||||

| | ![[MISSING IMAGE: ph_auerbachjonathan-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_auerbachjonathan-bw.jpg) Jonathan S. Auerbach | | | | ![[MISSING IMAGE: ph_riveraalfredo-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_riveraalfredo-bw.jpg) Alfredo Rivera | | | | ![[MISSING IMAGE: ph_richerclare-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_richerclare-bw.jpg) Clare S. Richer | | | | ![[MISSING IMAGE: ph_muruzabalclaudio-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_muruzabalclaudio-bw.jpg) Claudio N. Muruzabal | | | | ![[MISSING IMAGE: ph_beamsmaliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_beamsmaliz-bw.jpg) Mary E. “Maliz” Beams | | | | ![[MISSING IMAGE: ph_mitchellliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_mitchellliz-bw.jpg) H. Elizabeth Mitchell | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 9 | |

The

Directors that constitute the Board.

| | |||||

![[MISSING IMAGE: ph_hochschild-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_hochschild-bw.jpg) Roger C. Hochschild Age: 59 Director Since: 2015 Committees: Finance and Nominating and Governance (Chair) | | | | Career Highlights: Mr. Hochschild retired from Discover Financial Services, a digital banking and payment services company, after serving as the company’s President and Chief Executive Officer from 2018 until August 2023. Prior to those roles, starting in 2004, he was President and Chief Operating Officer of Discover Financial Services. Mr. Hochschild previously served as the Chief Marketing Officer of Discover Financial Services from 1998 to 2001. Prior to joining Discover, from 2001 until 2004, he served as the Chief Administrative Officer, Executive Vice President, and Chief Strategy Officer of Morgan Stanley. He served as a Senior Executive Vice President of MBNA America Bank from 1994 to 1998. Mr. Hochschild has been a Director of Chicago Public Media since 2016. Key Skills and Qualifications: Mr. Hochschild brings to the Board executive leadership experience through his service as president and chief executive officer of a large publicly traded digital banking and payment services company, as well as executive-level experience in financial services, accounting and finance, asset and investment management, retail consumer services, and technology. Education: Bachelor’s degree in economics from Georgetown University and an M.B.A. from the Amos Tuck School at Dartmouth College. Other Public Company Boards: Current: None Within Last Five Years: Discover Financial Services | |

| | | | ||

| | | 10 | |

| | ![[MISSING IMAGE: ph_danhouston-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_danhouston-bw.jpg) Daniel J. Houston Age: 62 Director Since: 2014 Committees:

| | | | Career Highlights:Mr. Mr. Houston joined the Company in 1984 and has served in various executive leadership roles, including serving as President, Retirement, Insurance and Financial Services of the Company and Principal Life Insurance Company. Mr. Houston is past Chairman of the Board of Directors of the American Council of Life Insurers and also serves on the Board of Directors of the Iowa Business Council, Greater Des Moines Partnership, Employee Benefits Research Institute, Iowa State University Business School Dean’s Advisory Council, Partnership for a Healthier America, and Community Foundation of Greater Des Moines. Key Skills and Qualifications: Mr. Houston brings to the Board extensive executive leadership and operational expertise, global awareness, and deep talent leadership skills through his experience of leading a large global financial services public company, including leading the Company’s transformation to a global Education: Bachelor of Other Public Company Boards: None | |

| | | | Notice of 2024 Annual Meeting of Shareholders and | | | 11 | |

| | ![[MISSING IMAGE: ph_dianenordin-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_dianenordin-bw.jpg) Diane C. Nordin Age: 65 Director Since: 2017 Committees: Audit (Chair) and Finance | | | | Career Highlights: Ms. Nordin was a partner of Wellington Management Company, LLP, a private asset management

Since 2016, Ms. Nordin has

|

|

| ||||

|

| |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 12 | |

| | ![[MISSING IMAGE: ph_riveraalfredo-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_riveraalfredo-bw.jpg) Alfredo Rivera Age: 62 Director Since: 2020 Committees: Audit and Human Resources | | | | Career Highlights: Mr. Rivera is the retired President of the North America Operating Unit of The Coca-Cola Company, a global total beverage company. Mr. Rivera served in this role from 2020 until December 2022 and served as a Senior Advisor from December 2022 until his retirement in March 2023. He helped lead The Coca-Cola Company’s transformation to emerge stronger as a total beverage company, enabled by a globally networked organization. Mr. Rivera joined The Coca-Cola Company in 1997 and served in various executive leadership roles, including serving as President, Latin America from 2016 to 2020 and President, Latin Center Business Unit from 2013 to 2016. Mr. Rivera was a director of the Coca-Cola Hellenic Bottling Company from 2018 to 2021. Key Skills and Qualifications: Mr. Rivera brings to the Board executive leadership experience through his service in executive leadership roles in a large global operations of a public company, as well as executive-level experience in accounting and finance, retail consumer, executive compensation, human resources and talent management, marketing, strategic planning, and sustainability/ESG. Education: Bachelor’s degree and M.B.A. from the University of Other Public Company Boards: None | |

| | | | ||

| | | 13 | |

| | ![[MISSING IMAGE: ph_blairpickerell-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_blairpickerell-bw.jpg) Blair C. Pickerell Age: 67 Director Since: 2015 Committees: Finance and Nominating and Governance | | ||||

| |

| | |||

| | ![[MISSING IMAGE: ph_richerclare-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_richerclare-bw.jpg) Clare S. Richer Age: 65 Director Since: 2020 Committees: Audit, Finance (Chair) and Executive | | | | Career Highlights: Ms. Richer was Chief Financial Officer of Putnam Investments, a global asset management firm (now part of Franklin Templeton), from 2008 to 2017. Prior to joining Putnam, Ms. Richer held several roles at Fidelity Investments from 1983 to 2008. Ms. Richer is a member of the Board of Directors of State Street Global Advisors SPDR ETF Funds. She is also a Trustee of the University of Notre Dame, serving as a member of the Compensation, Investment Finance, and Executive Committees. She served on the Board of Directors of the Alzheimer’s Association, MA/NH chapter. Key Skills and Qualifications: Ms. Richer brings to the Board extensive executive leadership experience, including through her service as a chief financial officer of a global asset management firm. She also brings to the Board executive-level experience in accounting and finance, product development, risk management, strategic planning, and technology. Education: B.B.A. from University of Notre Dame. Other Public Company Boards: Bain Capital Specialty Finance Inc. (member of the Audit, Compensation, and Nominating/Governance Committees). | |

| | | | ||

| | | 14 | |

| | ![[MISSING IMAGE: ph_mitchellliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_mitchellliz-bw.jpg) H. Elizabeth Mitchell Age: 62 Director Since: 2022 Committees: Audit and Finance | | | | Career Highlights: Ms. Mitchell was Chief Executive Officer of Renaissance U.S. Inc., and its predecessor Platinum Underwriters Reinsurance Inc., from 2007, and the company’s President from 2005 until her retirement in 2016. Prior to those roles, she served in various executive leadership roles at the company and at other firms, including serving as an Advisor to Hudson Structured Capital Management since 2018. Ms. Mitchell served as the non-executive Chair of Weston Insurance Company from 2020 until 2022. Ms. Mitchell is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. She is also a National Association of Corporate Directors (NACD) Certified Director. Key Skills and Qualifications: Ms. Mitchell brings to the Board executive leadership experience through her service as a chief executive officer of a global provider of reinsurance and insurance. She also brings to the Board executive-level experience in asset management, financial services, accounting and finance, strategic planning, sustainability/ESG, and technology. Education: Bachelor’s degree from the College of the Holy Cross and CERT Certificate in Cyber Security Oversight from Carnegie Mellon University. Other Public Company Boards: Current: Selective Insurance Group (Chair of the Audit Committee). Within Last Five Years: StanCorp Financial Corp. | |

| |

Continuing Class II Directors With Terms Expiring in 2018

![[MISSING IMAGE: ph_auerbachjonathan-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_auerbachjonathan-bw.jpg)

Age: 61 Director Since: 2019 Committees: Finance and Nominating and Governance | | | | Career Highlights: Mr. Auerbach was Executive Vice President, Chief Strategy, Growth and Data Officer of PayPal Holdings, Inc., a financial technology company, from 2015 until 2023. He led PayPal’s global strategy, acquisitions, partnerships, advanced analytics and data science, growth marketing, and corporate affairs teams. Mr. Auerbach also served as a strategic advisor to PayPal’s operations in China and was responsible for the company’s Blockchain, Crypto and Digital Currencies business unit and chaired PayPal’s Operating Group. Prior to joining PayPal, Mr. Auerbach was Chief Executive Officer of SingTel’s Group Digital Life from 2013-2014 and spent over 26 years with McKinsey & Company, serving in a variety of executive roles in Asia and North America, including leading the Asian Telecommunications, Media and Technology Practice, the Singapore Office, and Southeast Asia Region, and the North American High-Tech Practice. Mr. Auerbach serves on the Board of Directors of the National Committee on U.S.-China Relations and is a member of the Council of Foreign Relations. Key Skills and Qualifications: Mr. Auerbach brings to the Board executive leadership experience through his service as an executive vice president of a financial technology company, as well as executive-level experience in international operations, financial services, marketing, product development, risk management, strategic planning, sustainability/ESG, and technology. Education: Bachelor’s degree from Dartmouth College, and a B.A. and M.A. from Oxford University. Other Public Company Boards: None. | |

| | | | ||

| | | 15 | |

| | ![[MISSING IMAGE: ph_beamsmaliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_beamsmaliz-bw.jpg) Mary E. “Maliz” Beams Age: 68 Director Since: 2021 Committees:

| | | | Career Highlights: Since December 2022, Ms. Beams has been the Prior to

|

|

| |

| | | | |

| | |

|

| |

| |

Continuing Directors in Class I With Terms Expiring in 2017

|

| |

| |

![[MISSING IMAGE: ph_jocelyn-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_jocelyn-bw.jpg)

Jocelyn Carter-Miller |

and Executive | | | | Career Highlights: Since 2005, Ms. Carter-Miller has been President of TechEd Ventures, Before joining Office Depot, Ms. Carter-Miller serves on the Board of Directors of nonprofit organizations, including The National Association of Corporate Directors. She was a Ms. Carter-Miller is an NACD Directorship 100

Key Skills and Qualifications: Ms. Carter-Miller

Education: Bachelor’s degree in Other Public Company Boards: Current: Arlo Technologies, Inc. (Audit Committee, Chair of Compensation Committee); The Interpublic Group of Companies, Inc. (Audit and Executive Committees, Corporate Governance and Social Responsibility Chair); Backblaze, Inc. (Compensation Committee Chair, Audit Committee member, and Nomination and Governance Committee member). Within Last Five Years: Netgear, Inc. (Audit and Compensation Committees). | |

| | | | ||

| | | 17 | |

| | ![[MISSING IMAGE: ph_scottmills-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_scottmills-bw.jpg) Scott M. Mills Age: 55 Director Since: 2016 Lead Director since 2020 Committees: Audit, Human Resources and Executive | | ||||

| |

| | |||

| | ![[MISSING IMAGE: ph_muruzabalclaudio-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_muruzabalclaudio-bw.jpg) Claudio N. Muruzabal Age: 63 Director Since: 2021 Committees: Human Resources and Nominating and Governance | | | | Career Highlights: Mr. Prior to joining SAP, he served as Chief Executive Officer of NEORIS for 10 years, transforming the Mr. Muruzabal has been recognized consecutively from 2016 to 2023 with the HITEC 50 Award, as one of the Key Skills and Qualifications: Mr. Muruzabal brings to the Board executive leadership experience and technology and international operations experience, including through his service as president and chairman of various business units of a

Education: Bachelor’s degree from Other Public Company Boards: None. | |

| | | | |

| | |

| |

our shareholders. The Company's Board and management regularly review best practices for corporate governance and modify our policies and practices as warranted. Our current best practices include:

Ms. Tallett is thecurrent independent Lead Director, and Ms. Bernard is the Alternate Lead Director.

The Lead Director and Alternative Lead Director are selectedwas appointed by the independent Directors.Directors and assumed that role in 2020. The Nominating and Governance Committee reviews the assignmentsappointment of Lead Director and Alternate Lead Director annually.

•PresidesDirector presides when the Chairman is not present,andplans and leadsexecutive sessionsExecutive Sessions of independent Directors,("Executive Sessions").leads the Board’s annual self-evaluation, calls special Board meetings if the Chairman is unable to act, and leads the Board’s CEO succession planning discussions. Executive Sessions generally occur at the start

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 19 | |

addresses specific risks that the Company faces, including finance risk; product and pricing risk; operational and business risk; and strategic risk.

| | Committee | | | | Risk and Mitigation | |

| | Audit | | | | • Oversees risk and mitigation related to accounting, financial controls, legal, regulatory, ethics, compliance, operations, and general business activities; and • Oversees the framework and policies related to enterprise risk management. | |

| | Finance | | | | • Oversees risk and mitigation related to liquidity, credit, market, product, and pricing activities; • Oversees capital management, capital structure and financing, investment policy, tax planning, and key risks associated with significant financial transactions; and • Provides guidance to the Human Resources Committee on the appropriateness of Company financial goals used in annual and long-term employee incentive compensation arrangements. | |

| | Human Resources | | | | • Oversees risk and mitigation related to the design and operation of employee compensation arrangements to confirm they are consistent with business plans and are appropriately designed to limit or mitigate risk; • Reviews annually an analysis of the Company’s incentive compensation plans to ensure they are designed to create and maintain shareholder value, provide rewards based on the long-term performance of the Company, and do not encourage excessive risk; and • Oversees succession planning and development for senior management. | |

| | Nominating and Governance | | | | • Oversees risk and mitigation related to the Company’s environmental, sustainability, and corporate social responsibilities, as well as the Company’s political contribution activities; and • Monitors whether the Board and its committees have the collective skills and experience necessary to monitor the risks facing the Company. | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 20 | |

The Audit Committee: risk and mitigation related to accounting, financial controls, legal, regulatory, ethics, compliance, operations and general business activities.cybersecurity threats. The Audit Committee also oversees the framework and policies with respect to enterprise risk assessment and management.

The Finance Committee: risk and mitigation related to liquidity, credit, market, product and pricing activities. The Finance Committee also oversees capital management, capital structure and financing, investment policy, tax planning, and key risks associated with significant financial transactions.

The Human Resources Committee: risk and mitigation related to the design and operation of employee compensation arrangements to confirm they are consistent with business plans, do not encourage inappropriate risk taking and are appropriately designed to limit or mitigate risk. The Human Resources Committee also oversees succession planning and development for senior management.

The Nominating and Governance Committee: risks and mitigation related to the Company's environmental, sustainability and corporate social responsibilities as well as the Company's political contribution activities. The Nominating and Governance Committee also monitors the need for thefull Board and its committees to have the collective skills and experience necessary to monitor the risks facing the Principal.

Thereceives at least one cybersecurity report every quarter from our Chief Information Officer, our Chief Information Security Officer, our Chief Risk Officer, andor other membersprofessionals regarding the state of senior management provide reports and have discussions with the Board and its committees on our risk profile and risk management activities. Discussions include reviews of ongoing adherence to policy, impacts of external events, and how strategy, initiatives, and operations integrate with our risk objectives.cybersecurity program. The Board also reviews and approves the business resiliency and information security programs intended to guard against cybersecurity and related risks. Also, the Board receives perspectivesinput on cybersecurity matters from external entities such as our independent auditor, regulators, and consultants. These presentations and discussions provideEach of these steps furthers the Board with a greater understanding of the material risks the organization faces, the level of risk in actions presented for Board approval, how certain risks relate to other risks, and whether management is responding appropriately,

During 2015, the Board deepened its emphasis on cybersecurity risk and our information security program. The Board views this risk as an enterprise wide concern that involves people, process, and technology, and accordingly treats it as a Board level matter. It embodies a persistent and dynamic threat to our entire industry that is not limited to information technology. The Board will remain focused on this critical priority by continuing to receive regular reports from the Chief Information Officer and othersBoard’s efforts to ensure that it is monitoring cyber threat intelligencewe have established and takingare proactively maintaining an enterprise-wide cybersecurity risk program with appropriate policies, practices, and controls designed to ensure resiliency in the steps necessary to implement the needed safeguards and protocols to manage the risk.

In addition, the Company has an emergency succession plan for the CEO that is reviewed by the Board annually.

Standard and Director Resignation Policy

decide whether to accept the resignation. The Board'sBoard’s decision and reasons in support offor its decision will be publicly disclosed within 90 days of certification of the election results.

Some Directors have categorically immaterial relationships and transactions with Principal:

•Ms. Bernard, Dr. Gelatt, Ms. Helton,No Director other than Mr.Pickerell and Ms. Tallett are customers ofHouston has been employed by theCompany's subsidiaries. Prior to the Demutualization (see page 57), Directors were required to own an insurance policy or annuity contract issued by Principal Life InsuranceCompany("Principal Life"). All insurance policies, annuity contracts and agreements for trust services held by Directors are on the same terms and conditions as those offered to the public.•The Gelatt family companies (of which Dr. Gelatt is the CEO) and an affiliated trust own insurance and pension products issued by Principal Life.•Ms. Bernard, Mr. Pickerell and Ms. Tallett are directors, and Mr. Hochschild is an executive officer, of for profit entities with which the Company's subsidiaries conducted ordinary commercial transactions.

at any time.

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 21 | |

During 2015, Principal Management Corporation, an affiliate of the Company ("PMC"), paid Wellington Management Company $3,990,303.76 for sub-advisory services furnished to a registered investment company The Company’s affiliates hold and manage accounts holding securities issued by Nippon Life, and Nippon Life invests in funds managed by PMC. Asthe Company’s affiliates.

As of December 31, 2015, the Vanguard Group, Inc. managed funds holding in the aggregate 8.3% of the Company's Common Stock. During 2015 Principal Shareholder Services, Inc. paid Vanguard $88,427.27 for sub-transfer agent services. Vanguard paid $1,059,786 in rent for lease of space to a borrower of the Principal Life Insurance Company general account.

arrangements with related parties. The Nominating and Governance Committee or its Chair must approve or ratify all transactions with Related Partiesrelated parties that are not preapproved underby or exempted from the Company'sCompany’s Related Party Transaction Policy.Policy (the “Policy”). At each quarterly meeting, the Nominating and Governance Committee reviews any nonmaterial transactions with Related Parties. The Committeerelated parties and ratifies these transactionsany transaction that is subject to the Policy if it determines they are appropriate.it is appropriate and may attach conditions to that approval. Transactions involving employment of a relative of an executive officer or Director must be approved by the Human Resources Committee. The Company'sCompany’s Related Party Transaction Policy may be foundis publicly available at www.principal.com.

Each Director and officer of the

https://investors.principal.com/investor-relations/our-business/corporate-governance/default.aspx.

and Responsibilities

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 22 | |

Current membershipwww.principal.com.

| Committee | |||||||||||

| | | | Responsibilities | | | | Members (*Committee Chair) | | | ||

| | Meetings | | |||||||||

| Audit | | | | •

Appoints, terminates, compensates, and •

Reviews and •

Approves all audit engagement fees and •

Reviews internal audit plans and results; •

Reviews and •

Reviews the management; and • All members of the Audit Committee are financially literate and are independent, as defined in the | |||||||

| | | | Mary E. “Maliz” Beams Scott M. Mills H. Elizabeth Mitchell Diane C. Nordin* Clare S. Richer Alfredo Rivera | | | | 8 | | |||

| Human Resources | | | |||||||||

| | employees; | | | | Jocelyn Carter-Miller* Roger C. Hochschild Scott M. Mills Claudio N. Muruzabal Alfredo Rivera | | | | 8 | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 23 | |

| Committee | | | | Responsibilities | | | | Members (*Committee Chair) | | | | Meetings held in 2023 | |

| | | | | that they encourage management to take appropriate risks; discourage inappropriate | tolerance; • Reviews the Company’s pay equity processes; and | • Reviews the Company’s human capital disclosures. | |||||||

| | | | | ||||||||||

| | | | | | |||||||||

| Nominating and Governance | | | | • Recommends Board candidates, Board committee assignments, and service as Lead • Reviews and reports to the Board on Director independence, performance of individual Directors, process for the annual and • Reviews environmental and corporate social responsibility matters as well as the | |||||||||

| | | | Jocelyn Carter-Miller Roger C. Hochschild* Claudio N. Muruzabal Blair C. Pickerell |

| | | | 5 | | |||||||||

| Finance | | | | ||||||||||

| | ||||||||||||

| | | | |||||||||||

Mary E. H. Elizabeth Mitchell Diane C. Nordin Blair C. Pickerell | |||||||||||||

Clare S. Richer* | | | | 7 | | ||||||||

| Executive | | | | • Acts on matters delegated by the Board which must be approved by its independent • Has the authority of the Board between Board meetings unless the Board has directed otherwise or as mandated by law and in the By Laws. | |||||||||

| | | | Jocelyn Carter-Miller Daniel J. Houston* Scott M. Mills Clare S. Richer | | | | None | | |||||

| | |||||||||||||

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 24 | |

(1)As

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 25 | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 26 | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 27 | |

of Non-Employee Directors

The Director Mr. Houston, our Chairman, President, and Chief Executive Officer, does not receive additional compensation program is reviewed annually. for his service on the Board.

| | |||||

Annual Cash Retainers1(Effective November 20, 2023) | | | |||

| | |||||

| | | ||||

| | Board | ||||

| | | | |||

| | |||||

| | |||||

| | | | $ | | |

| | |||||

| | | | $ | | |

| | |||||

| | | | $ | | |

| | |||||

| | | | $ | | |

| | |||||

| | | | $ | | |

| | |||||

| | | | $ | | |

| | |||||

| Annual Restricted Stock Unit Retainer | |||||

| | | | $200,000 | |

(1)- 1

Effective January 4, 2016, Mr. Zimpleman became a non executive Chairman of the Board, and he will be paid an annual retainer of $200,000 for this service, in addition to the normal compensation provided to non-employee members of the Board, both prorated for the period January 1 - May 17, 2016.

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 28 | |

2023

| | Name | | | | Fees Earned or Paid in Cash | | | | Stock Awards1 | | | | Total | |

| | Jonathan S. Auerbach | | | | $115,000 | | | | $184,965 | | | | $299,965 | |

| | Mary E. “Maliz” Beams | | | | $115,000 | | | | $184,965 | | | | $299,965 | |

| | Jocelyn Carter-Miller | | | | $140,000 | | | | $184,965 | | | | $324,965 | |

| | Michael T. Dan2 | | | | $57,500 | | | | $0 | | | | $57,500 | |

| | H. Elizabeth Mitchell | | | | $115,000 | | | | $184,965 | | | | $299,965 | |

| | Roger C. Hochschild | | | | $140,000 | | | | $184,965 | | | | $324,965 | |

| | Scott M. Mills | | | | $165,000 | | | | $184,965 | | | | $349,965 | |

| | Claudio N. Muruzabal | | | | $115,000 | | | | $184,965 | | | | $299,965 | |

| | Diane C. Nordin | | | | $150,000 | | | | $184,965 | | | | $334,965 | |

| | Blair C. Pickerell | | | | $115,000 | | | | $184,965 | | | | $299,965 | |

| | Clare S. Richer | | | | $150,000 | | | | $184,965 | | | | $334,965 | |

| | Alfredo Rivera | | | | $115,000 | | | | $184,965 | | | | $299,965 | |

| | | | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |||||

| Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | Total | | |||||

| | | | | | | | | |||||

| Betsy J. Bernard | | | $ | 132,000 | | | $ | 129,990 | | $ | 261,990 | |

| | | | | | | | | |||||

| Jocelyn Carter-Miller | | | $ | 133,000 | | | $ | 129,990 | | $ | 262,990 | |

| | | | | | | | | |||||

| Gary E. Costley | | | $ | 119,000 | | | $ | 129,990 | | $ | 248,990 | |

| | | | | | | | | |||||

| Michael T. Dan | | | $ | 130,000 | | | $ | 129,990 | | $ | 259,990 | |

| | | | | | | | | |||||

| Dennis H. Ferro | | | $ | 127,500 | | | $ | 129,990 | | $ | 257,490 | |

| | | | | | | | | |||||

| C. Daniel Gelatt Jr. | | | $ | 123,500 | | | $ | 129,990 | | $ | 253,490 | |

| | | | | | | | | |||||

| Sandra L. Helton | | | $ | 142,000 | | | $ | 129,990 | | $ | 271,990 | |

| | | | | | | | | |||||

| Roger C. Hochschild | | | $ | 126,943 | | | $ | 145,143 | | $ | 272,086 | |

| | | | | | | | | |||||

| Richard L. Keyser | | | $ | 6,000 | | | $ | 0 | | $ | 6,000 | |

| | | | | | | | | |||||

| Luca Maestri | | | $ | 6,000 | | | $ | 0 | | $ | 6,000 | |

| | | | | | | | | |||||

| Blair C. Pickerell | | | $ | 83,189 | | | $ | 97,866 | | $ | 181,055 | |

| | | | | | | | | |||||

| Elizabeth E. Tallett | | | $ | 139,000 | | | $ | 129,990 | | $ | 268,990 | |

| | | | | | | | | |||||

(1)TheThese amountsshown in this columnreflect the grant date fair value of awards made in2015,2023 determined in accordance with FASB Accounting Standards Codification("ASC"(“ASC”) Topic 718. These awards do not reflect actual amounts realized or that may be realized by the recipients.

Directors'Non-EmployeeNon-employee Directors of Principal Financial Group, Inc. This Plan has four investment options:•Phantomoptions, and each option represents “phantom” units tied to the Company's Common Stock;•The Principal LargeCap S&P 500 Institutional Index Fund;•The Principal Real Estate Securities Institutional Fund; and•The Principal Bond & Mortgage Securities Institutional Fund.All of these funds are available to participants in Principal Life's Excess Plan. The returns realized on these funds during 2015 are listed in the table "Qualified 401(k) Plan and Excess Plan," on pages 44-45. Investment Option 1-Year Rate of Return

(12/31/2023) Principal Financial Group, Inc. Employer Stock Fund 15.59% Principal LargeCap S&P 500 Index Fund (R5) 25.75% Principal Real Estate Securities Fund (R5) 13.08% Principal Core Plus Bond Fund (R5) 5.22% Restricted Stock Units ("RSUs"). The grant made in 2015 was madetime-based RSUs under the Principal Financial Group, Inc. 2014 Directors2021 Stock Plan.Incentive Plan, as amended and restated Effective November 20, 2023 (the “2021 Stock Incentive Plan”). RSUs are granted at the time of the annual meeting, vest at the next annual meeting, and are deferred until at least until the date the Director leaves the Board. At payout, the RSUs are converted to shares of Common Stock. Dividend equivalents become additional RSUs, which vest and are converted to Common Stock at the same time and to the same extent as the underlying RSU.RSUs. The Nominating and Governance Committee has the discretion to make a prorated grant of RSUs to Directors who join the Board at a time other than at the annual meeting. While the 2014 DirectorThe 2021 Stock Incentive Plan, (which was approved by shareholders) affords some discretion in determining the dollar value of RSUs that may annually be awarded to each non-employee Director, it imposes a combined maximum limit for stock awards plus fees and retainers of $230,000$750,000 ($500,0001,000,000 for an Independent Chairman) on the size of the annual award that may be made to any non-employee Directors..

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 29 | |

| | ||||||

| Director Name | ||||||

| ||||||

| ||||||

| ||||||

| | | | Total RSUs Outstanding Fiscal Year End 2023 (Shares) | | ||

| | |||||

| | | | ||||

| | |||||

| | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| | | | 5,963 | | ||

| | |||||

| | | | ||||

| | |||||

| | H. Elizabeth Mitchell | | | |||

| | | ||||

| | Roger C. Hochschild | | | | 28,403 | |

| | Scott M. Mills | | | | 23,517 | |

| | Claudio N. Muruzabal | | | | 4,972 | |

| | Diane C. Nordin | | | | 19,141 | |

| | Blair C. Pickerell | | | | 26,891 | |

| | Clare S. Richer | | | | 10,036 | |

| | Alfredo Rivera | | | | 6,956 | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 30 | |

2023. The Audit Committee also discussed with Ernst & Young LLP the Company's independent auditor, the matters required to be discussed by Statement on Auditing Standards ("SAS") 114, The Auditor's Communication with those Charged with Governance, as adopted bythe applicable requirements of the Public Company Accounting Oversight Board (United States) ("PCAOB"(“PCAOB”) in Rule 3200T. SAS 114 requiresand the independent auditor to communicate (i) the auditor's responsibility under standards of the PCAOB; (ii) an overview of the planned scopeSecurities and timing of the audit; and (iii) significant findings from the audit, including the qualitative aspects of the entity's significant accounting practices, significant difficulties, if any, encountered in performing the audit, uncorrected misstatements identified during the audit,

other than those the auditor believes are trivial, if any, any disagreements with management, and any other issues arising from the audit that are significant or relevant to those charged with governance.

Exchange Commission. The Audit Committee also received from Ernst & Young LLP, the written disclosures and letter required by applicable requirements of the PCAOB regarding the independent auditor'sregistered accounting firm’s communications with the Committee concerning independence. Theindependence, and the Committee has discussed with Ernst & Young LLP its independenceindependence.

The Committee discussed with the Company's internal and independent auditors the overall scope and plans for their respective audits. The Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls and the overall quality of the Company's financial reporting.

In reliance on the reviews and discussions referred to above, theAudit Committee recommended to the Board (andthat the Board approved) that theCompany’s audited financial statements be included in the Company'sCompany’s Annual Report on Form 10-K for the year ended December 31, 2015, for filing with the SEC. The Committee has also approved, subject to shareholder ratification, the appointment of Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2016.

The Committee does not have the responsibility to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of the Company's independent auditor and management. In giving our recommendation to the Board, the Committee has relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of the Company's independent auditor with respect to such financial statements.

Sandra L. Helton,2023.

Mary E.

Scott M. Mills

H.

Clare S. Richer

Alfredo Rivera

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 31 | |

| | ||||||||

| Contents: | | Page: | | |||||

| | Compensation Discussion & Analysis | | | | | | | |

| | | | | | 33 | | ||

| | | ||||||

| | | | |||||

| | •

| | | | | | | |

| | | | | | 34 | | | |

| | | | | | 35 | | | |

| | | | | | 36 | | | |

| | | | | | | | ||

| | •

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 44 | | | |

| | | | | | | | ||

| | •

| | | | | | | |

| | •

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | •

| | | | | | | |

| | •

| | | | | | | |

| Compensation Tables | | | | | | | |

| | •

| | | | | | | |

| | •

| | | | | | | |

| | •

| | | | | | | |

| | •

| | | | | | | |

| | •

| | | | | | | |

| | | | | | 56 | | | |

| | | | | | 56 | | | |

| | | | | | 57 | | | |